Securing a rental in Santa Fe can be challenging for low-income renters, particularly those facing credit issues. Many landlords rely on credit checks to assess tenant reliability, and a poor credit score can limit your options. This comprehensive guide provides actionable steps for improving credit score for Santa Fe rental, ensuring you can confidently navigate the housing market and increase your chances of securing a home.

Understanding Credit Scores and Their Importance

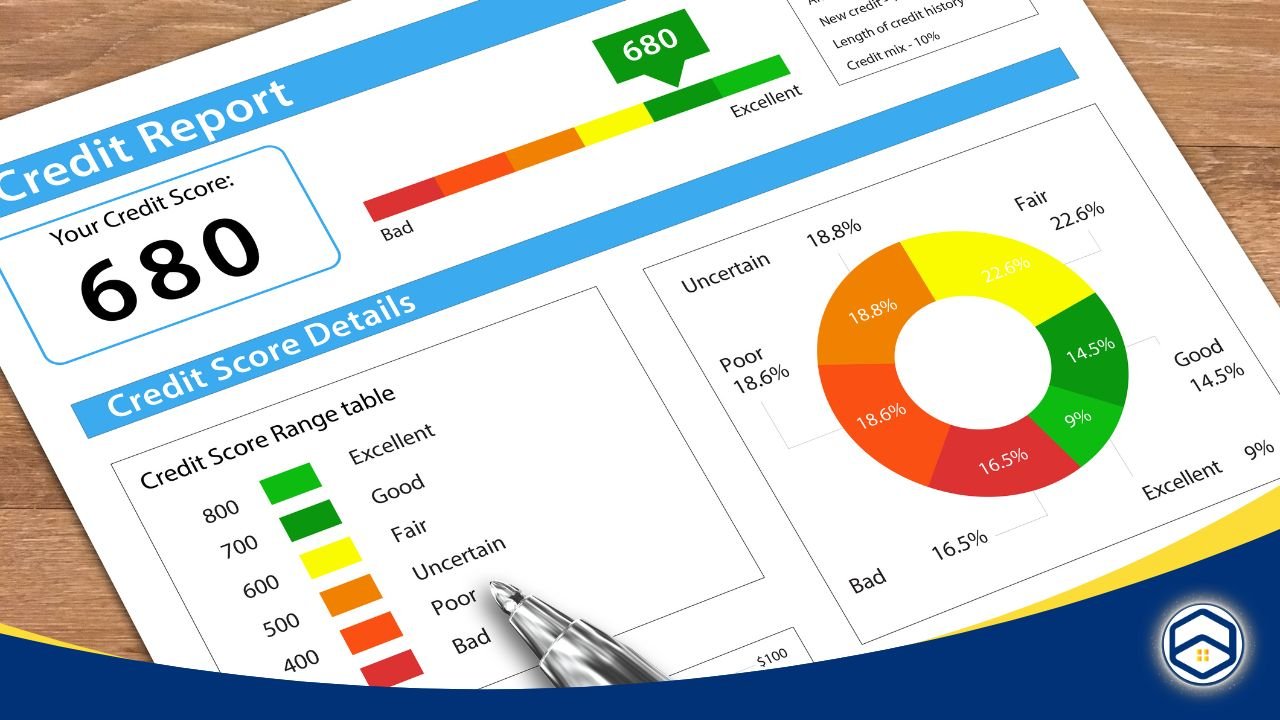

A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. It is a critical factor in financial decisions, including securing housing, loans, and credit cards. Your credit score is determined by evaluating several factors:

- Payment history (35%): Timely payments on bills and debts.

- Credit utilization (30%): The ratio of your credit card balances to your credit limits.

- Length of credit history (15%): How long your credit accounts have been active.

- New credit inquiries (10%): Recent applications for credit.

- Credit mix (10%): The diversity of your credit accounts, such as loans and credit cards.

Credit scores fall into specific ranges:

- 300-579: Poor — May lead to loan rejections or higher interest rates.

- 580-669: Fair — Accepted by some lenders but not ideal.

- 670-739: Good — Preferred by landlords and lenders.

- 740-799: Very Good — Eligible for better financial opportunities.

- 800-850: Excellent — Grants access to the best rates and terms.

For Santa Fe rentals, landlords generally seek tenants with a credit score in the Good range or higher, as this demonstrates reliability and financial responsibility. However, even if your score falls into the Fair category, don’t be discouraged. There are actionable steps you can take to improve your creditworthiness. Enhancing your credit score not only increases your chances of approval for a rental but also strengthens your financial stability overall.

Taking steps to address credit issues and consistently working toward improving credit score for Santa Fe rental applications can make a significant difference. As you boost your score, you’ll gain access to better housing options, lower interest rates, and enhanced financial opportunities that support your long-term goals.

Improving Credit Score for Santa Fe Rental: Step-by-step

1. Review and Correct Your Credit Report

Start by obtaining a free credit report from AnnualCreditReport.com. Look for inaccuracies such as incorrect balances or accounts you don’t recognize.

- Dispute errors with credit bureaus (Experian, Equifax, and TransUnion).

- Monitor your report regularly to stay informed about changes.

Why It Helps: Correcting errors can quickly improve your credit score, making you a more attractive candidate for Santa Fe rentals.

2. Pay Bills on Time

Since payment history accounts for 35% of your credit score, timely bill payments are critical.

- Set up reminders or automatic payments for utilities, loans, and credit cards.

- Always pay at least the minimum amount due.

Why It Helps: On-time payments demonstrate reliability, which appeals to both lenders and landlords.

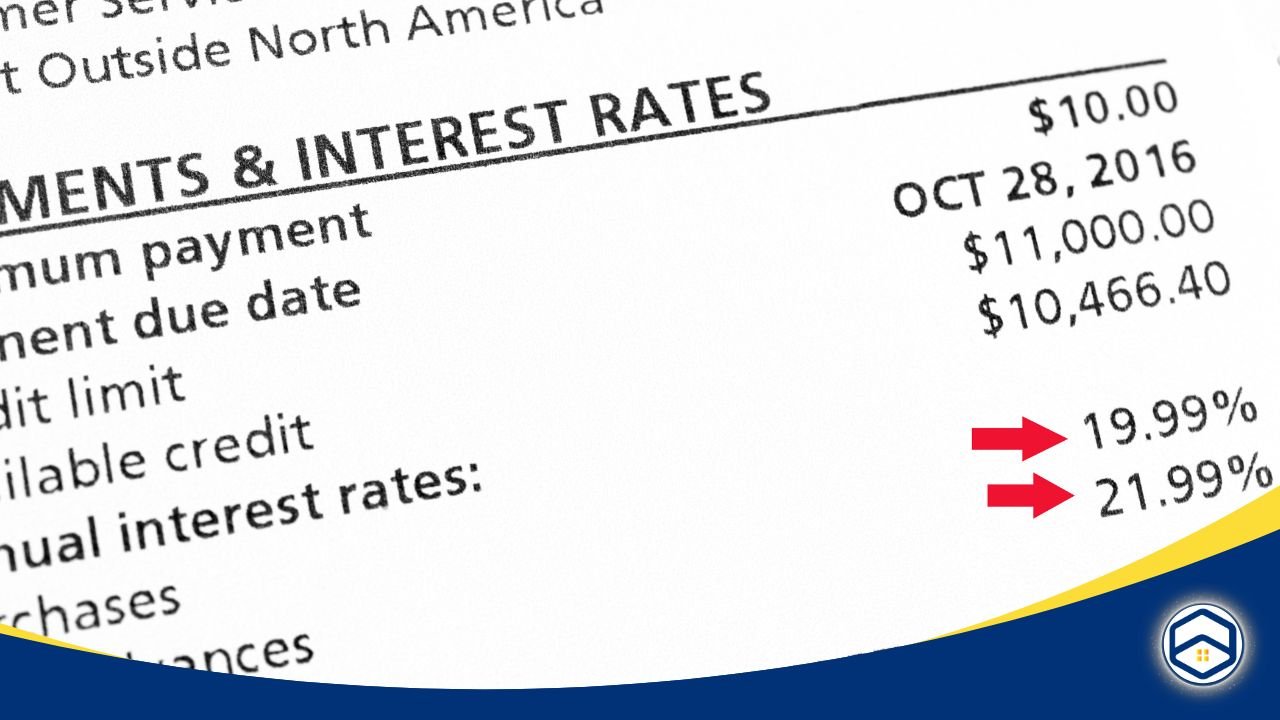

3. Reduce Credit Card Balances

For improving credit score for Santa Fe rental, Credit utilization which the ratio of your credit card balances to your limit directly impacts your score.

- Aim to keep balances below 30% of your credit limit.

- Prioritize paying off high-interest debts first.

Why It Helps: Lowering credit utilization shows responsible credit management, improving your overall credit health.

4. Use Rent Payment Reporting Services

Enroll in programs like RentTrack or Experian RentBureau to report your rent payments to credit bureaus.

- Ask your landlord if they participate in such services.

- Sign up independently if the landlord does not offer it.

Why It Helps: Consistent rent reporting adds positive history to your credit profile.

5. Become an Authorized User

Ask a family member or friend with good credit to add you as an authorized user on their credit card.

- You won’t need to use the card; their positive payment history benefits your credit.

Why It Helps: This can give your credit score a quick boost by leveraging someone else’s strong credit profile.

6. Open a Secured Credit Card or Credit-Builder Loan

Secured credit cards and credit-builder loans are effective tools for establishing or rebuilding credit.

- Secured Credit Cards: Require a cash deposit as collateral and help build credit with responsible use.

- Credit-Builder Loans: Report your payments to credit bureaus, improving your credit score.

Why It Helps: These tools create positive credit history, essential for renters with no or poor credit.

7. Address Collections and Past-Due Accounts

If you have debts in collections, negotiate a settlement or request a “pay-for-delete” agreement to support improving credit score for Santa Fe rental applications.

- Set up manageable payment plans to resolve outstanding debts.

Why It Helps: Clearing past-due accounts reduces the negative impact on your credit score.

8. Avoid Hard Credit Inquiries

Each hard inquiry, such as a credit application, temporarily lowers your score.

- Limit credit applications during this improvement phase.

- Request landlords to use soft inquiries when conducting credit checks.

Why It Helps: Reducing hard inquiries preserves your existing credit standing.

Additional Strategies for Low-Income Renters

Improving your credit score while navigating rental challenges can feel overwhelming, but there are practical strategies designed to alleviate financial strain and help you stay on track. For low-income renters, shared housing and financial counseling are two effective solutions to explore.

Consider Shared Housing Options

Shared housing provides an opportunity to reduce rental costs and bypass stringent credit requirements often associated with traditional leases. Platforms like PadSplit and Roommates.com specialize in connecting renters with affordable shared living spaces, making housing more accessible for individuals with limited income or credit challenges.

- PadSplit: This platform offers private, furnished rooms with utilities included in the weekly rent. PadSplit properties often feature flexible terms, allowing renters to avoid the hefty deposits or long-term commitments associated with conventional rentals.

- Roommates.com: A trusted service for finding compatible roommates based on preferences like budget, lifestyle, and location. Sharing rent with others can significantly lower individual costs and help renters save more for credit-building efforts.

Why It Helps: Shared housing allows you to allocate more of your income toward paying down debts or building savings, which are crucial for improving your credit score. Additionally, some shared housing arrangements may not require credit checks, easing the path to securing a place to live.

Seek Financial Counseling

For those struggling with debt or poor credit, nonprofit organizations like United Way and Catholic Charities offer invaluable financial counseling services. These programs are often free or available at a low cost, making them accessible for low-income renters.

- United Way: Provides comprehensive financial stability programs, including budgeting workshops, credit improvement strategies, and personalized debt management plans.

- Catholic Charities: Focuses on financial literacy, offering one-on-one credit counseling sessions and resources for reducing debt. They also provide additional support services like rental assistance and emergency financial aid.

Why It Helps: Financial counselors analyze your unique financial situation and develop tailored plans to improve your credit score. With professional advice, you can gain clarity on how to manage existing debts, create effective repayment strategies, and establish habits that build long-term financial stability.

Resources for Improving Credit

Improving your credit score is a critical step in securing a rental, and utilizing the right resources can make this process more effective. Here are some trusted tools and organizations that provide support for building and maintaining strong credit, especially for low-income renters aiming for improving credit score for Santa Fe rentals.

- AnnualCreditReport.com: Free credit reports.

- Consumer Financial Protection Bureau (CFPB): Tools for managing credit.

- Nonprofit Support: Look for local organizations offering credit-building assistance.

How Long Does It Take to Improve Your Credit?

Improving your credit score is not an overnight process but a journey that requires patience, consistency, and strategic actions. The time it takes to see noticeable changes in your credit score depends on the starting point of your credit health and the specific steps you take to address issues.

For small adjustments, such as correcting errors on your credit report or starting to pay bills on time, positive changes can appear within one to three months. For example, disputing inaccuracies like incorrect balances or fraudulent accounts with the credit bureaus can lead to quick updates, as resolved errors are reflected in your credit score promptly.

Similarly, consistent on-time payments for utilities, credit cards, or loans show financial reliability, which can gradually boost your score. These small steps are ideal for renters working toward improving credit score for Santa Fe rental in a short timeframe.

Final Thoughts

Improving credit score for Santa Fe rental is essential for securing a rent, particularly for low-income renters. By addressing errors in your credit report, paying bills on time, reducing credit utilization, and leveraging tools like secured credit cards, you can improve your creditworthiness. While it takes persistence and time, the rewards extend beyond housing to long-term financial stability and better opportunities.

Take the first step today by implementing these strategies and monitoring your progress. At HEXA Property Management, we’re here to support your rental journey. Visit Hexapm.com to explore affordable housing options in Santa Fe and start building your future with confidence!