Looking back at the rental market price statistics for 2023 offers insights into the changes in rent trends and housing. These past shifts have influenced how people find and afford homes. Looking ahead to 2024, the rental market seems poised for further adjustments, affecting the choices renters have and how landlords manage their properties.

Rental market price statistics 2023 – A look back

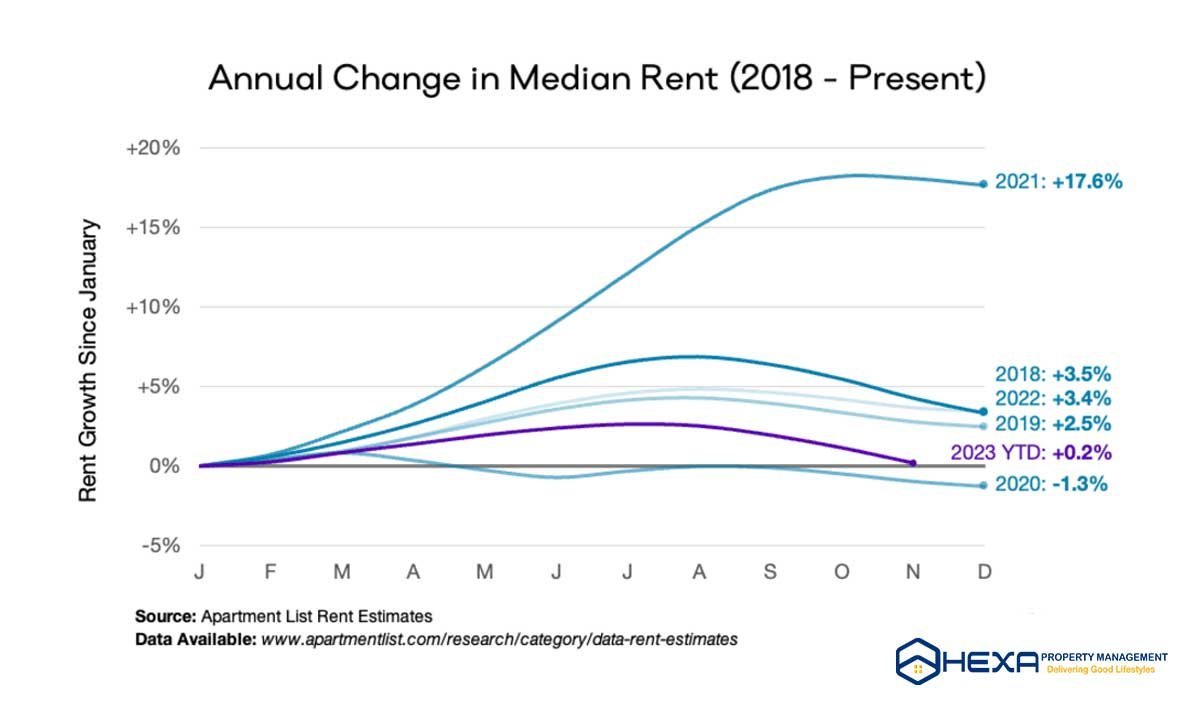

Looking back at 2023, the rental market slowed down a lot. The national rent growth went from a high of 18 percent to a drop of 1.1 percent.

This change happened because not many new households were forming, homes were getting really expensive, prices were going up, and people were worried about the economy.

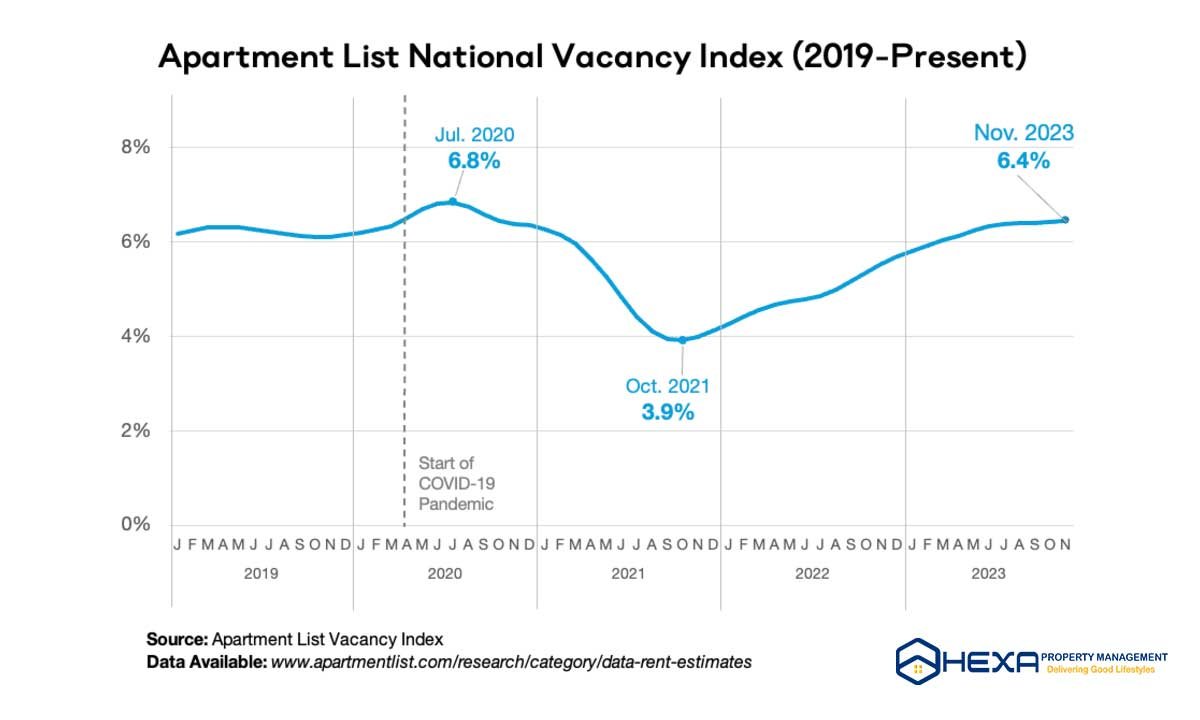

There were a lot more apartments being built, so there were more empty ones, with about 6.4 percent of apartments unoccupied across the country.

Most of the big cities in the U.S. had rents going down compared to the year before, and 83 cities had slower rent increases than in 2022.

Is rent going up or down in 2024?

When we peek at the rental market trends for 2023 and what’s in store for 2024, a big question stands out: are rents going up or down? The recent scene is a bit mixed.

November saw rents drop by a tiny 0.2% compared to the month before, showing things are shifting a bit. This isn’t how things usually roll at this time of year, where changes in rent are usually small.

Rent hikes, which used to be steady until February 2022, have slowed down noticeably. Before the pandemic, rents would go up by around 4.0% to 4.2% each year. But nowadays, things seem to be cooling off a bit, suggesting a slower rental market.

The reason for this slowdown seems to be the flood of new apartment buildings going up. More than 30% of places for rent are now offering deals, probably because of all this new construction.

Also, single-family homes are seeing rent go up more compared to apartments. In November, the usual rent for a single-family house was around $2,148, while apartments were about $1,845.

Looking ahead, things might keep changing. High costs for loans might make it tough for more apartment buildings to get built. If this happens, renting might become more popular than buying because it could be cheaper.

This could mean a bigger demand for rental homes. So, in 2024, we might see some big shifts in how the rental market works.

Rental Market Price Statistics 2024 – 7 Key predictions

#1 – The largest number of new apartments in 10 years

According to construction data from the Census Bureau, it is projected that the growth in multifamily supply will continue to be robust through 2024.

There’s been a major push to construct a record number of around one million new units by 2023, which is the most we’ve seen in a long time. The peak of all these buildings is expected to hit in 2024, making it the busiest year for new apartments since the 1980s.

This surge is partly because of higher interest rates, which have slowed down how many new buildings are getting started. Even though this surge might slow down by 2025, it won’t affect the number of new apartments being finished until later.

For renters, this is good news – in 2024, there will likely be lots more options available when looking for a new place. But for landlords and building managers, this means more competition as they deal with all the new apartments hitting the market.

#2 – Low rent growth

In 2024, the rental market seems like it’ll have slow rent growth, staying in the low single digits.

Looking back at 2023, rent didn’t go up much, marking the second slowest increase since 2017, only beaten by the sluggish growth seen in 2020. Even though there’s a small expectation for more people wanting rentals in 2024, things might stay a bit slow.

There are good signs like lots of jobs available and more people wanting to move into new homes, but rent being affordable is still a big worry. People don’t seem too confident about the economy, which could affect how many people decide to rent.

It looks like there might be more places for rent than people wanting them, meaning the number of empty rentals might go up a bit in 2024. Even though rent might start going up a bit at the start of the year, it’s unlikely to rise by much throughout 2024.

These expectations show a steady rental market with slow but steady growth, balancing how many places are available with how many people want to rent them.

#3 – More long-term renters

In 2024, it looks like more people might choose to rent instead of buying homes. One reason is that there won’t be a big increase in the demand for apartments and condos. Also, it’s still hard for many people to buy homes because they’re really expensive and mortgage rates are going up, slowing down how many homes are getting sold.

Even people with low mortgage rates are holding onto their homes instead of selling. This means families are staying in rental homes for longer. Some people who could buy homes are finding it smarter to keep renting.

The trend of Americans renting for longer, even when they’re older, is likely to keep going. While there’s a small hope that mortgage rates might go down a bit next year, it won’t change much for people trying to buy homes. With buying homes getting tougher, renting is just a more practical choice for many.

#4 Hybrid work will cement itself as the new norm for office jobs

Even though companies are talking about getting back to the office, hybrid work has firmly settled as the new normal throughout 2023. About 28% of workdays are staying remote, leveling off at that rate.

A significant 42% of American workers now enjoy some kind of flexibility in their work setup, with more opting for hybrid arrangements than fully remote ones.

This shift in work style is causing a surge in the demand for rental homes with extra rooms and shared workspaces, as people adapt their homes for their new work-life balance.

Additionally, areas farther from big job hubs might see more interest, as fewer commutes mean more flexibility in where people choose to live.

This change to hybrid work is sparking a need for rental properties that cater to the needs of a workforce that’s looking for flexibility in how and where they work.

#5 – Sun Belt markets will see more renters, but not necessarily higher rents

Sun Belt markets, especially in places like Texas and Florida, are likely to attract more renters. These areas have seen a surge in population over the past few years, leading to significant growth.

Some markets even saw rents shoot up as they tried to keep up with this growth by building more homes. Austin took the lead in permitting the most new homes per person from 2020 to 2023, and other Sun Belt cities followed suit.

The expected completion of these new housing projects in 2024 is going to introduce a lot of new homes to the Sun Belt markets. There’s still strong demand in these areas, especially from millennials looking for more space and chances to own homes.

But, even with this population growth, the expected increase in rents might not happen as new homes will balance out the demand. For example, in Austin, rents are actually going down despite more people moving in, showing how the increased supply is affecting prices.

So, while Sun Belt markets will keep attracting renters, the growth in rent prices might slow down because of all the new homes being built.

#6 – Housing concerns as the economy becomes central in the presidential election

As we head into the next presidential election, housing problems are shaping up to be a big deal.

Even though the economy might seem okay by some measures, lots of people aren’t feeling confident about it. One reason for this is that housing is getting more expensive, making it hard for renters, especially, to afford a place to live.

The Biden administration is trying to fix this by making more homes available and cheaper.

There’s also support from both sides of politics for changes in zoning rules to build more houses. Renters make up a big part of voters, and their needs could swing the election if candidates pay attention. Looking back, renters often lean toward Democratic candidates, which might be the case in a hypothetical 2024 rematch favoring President Biden.

Both sides of the political aisle will have to come up with plans to tackle these housing issues because they’re becoming a huge deal in the upcoming election.

#7 – More renters will use AI in their searches

Next year, there are new AI tools that renters can use to search for places, compare options, and manage their rental tasks better. More renters are expected to use these tools, and this might change how the rental market works when there’s a lot of demand.

This rise in AI tools for renters is a chance for both renters and property managers to benefit. But in 2024, there will also be other changes, like more homes available and ongoing issues with owning homes that still affect how many people want to rent.

What led to the surge in rental prices in the past?

Rental prices went up because of lots of different things that changed how renting works.

Inflation and limited options

Since 2020, prices for everything have been going up, including rent. There aren’t enough rental homes available, and when temporary freezes on rent ended, it made finding affordable places tougher.

Work changes and demand for smaller spaces

People’s work preferences shifted, with more people wanting flexibility and smaller homes because of remote work. This raised the demand for these types of places, nudging rents higher.

Barriers to buying homes

It’s been tough for many to buy homes, so more people turned to renting instead. This increased competition among renters and pushed rental prices higher.

Interestingly, while housing prices dropped, rent stayed high. This difference happened because mortgage rates rose, making buying homes less appealing.

But in 2022, there was a big increase in building apartments and condos. This surge in construction might ease the pressure on rent prices and create more affordable housing options.

To help renters, the Biden administration proposed a plan called the “Blueprint for a Renters Bill of Rights.” This plan aims to make renting more affordable and protect tenants better.

These steps show efforts to address the issues pushing up rental prices, hinting at potential changes ahead in the rental market.

Impact of Rent Price Trends on Renters

The shifting trends in rent prices have a significant impact on renters, shaping their housing experiences in various ways.

Affordability challenges

Rising rents can put a real squeeze on renters’ wallets, making housing costs a larger chunk of their expenses. This might force tough choices for some, juggling other necessities against higher housing expenses.

Regional variations

Rent prices aren’t the same everywhere; they vary widely based on where you live. What you pay in one city might be vastly different from another.

Renters need to keep an eye on these local differences to make informed decisions about where to live.

Policy awareness

Knowing the rules and policies that affect renters is crucial. Changes in laws about rent control or eviction policies can directly impact how much you pay and your rights as a renter. Staying informed can protect you and your finances.

Long-term planning

When thinking about where to live for a while, it’s smart to consider how rent prices might change over time. Understanding how the housing market works and the trends in rent prices helps renters make smarter decisions for the long haul, ensuring they can afford where they live.

Wrapping up, the rental market shift in 2023 had significant implications for people searching for homes and dealing with housing costs. Looking into 2024, it appears that further changes are looming, poised to affect renters’ housing decisions and landlords’ management strategies in significant ways.

These anticipated shifts may influence the options available to renters and how property owners navigate the rental landscape, hinting at a dynamic year ahead in the housing market.