Securing a rental in Santa Fe can be challenging, and having bad credit may make it even harder. However, with the right strategies, knowledge, and persistence, you can find a suitable home. This guide offers an in-depth look at the obstacles, solutions, and resources available to help you navigate the rental market in Santa Fe, even with a low credit score.

Challenges of Renting with Bad Credit Santa Fe

For renters with bad credit, these perceptions can create significant challenges, especially in a competitive market like Santa Fe.

How Bad Credit Impacts Your Rental Prospects?

A credit score below 600 is often considered suboptimal by landlords and property managers. This can be interpreted as a history of financial instability due to factors such as:

- Late Payments: Demonstrating a pattern of overdue bills may signal unreliability in paying rent on time.

- High Debt-to-Income Ratios: If a large portion of your income is tied up in debt repayment, landlords may question your ability to afford monthly rent.

- Bankruptcies or Evictions: Such records on a credit report are red flags that may lead to outright rejections.

These factors can result in:

- Rejected Applications: Many landlords may not proceed with tenants who have bad credit, especially when they have multiple applicants to choose from.

- Higher Security Deposits: To mitigate perceived risks, landlords may require deposits equivalent to two or even three months’ rent.

- Stricter Lease Terms: Landlords may insist on additional measures such as co-signers, shorter lease terms, or monthly prepayments.

Why do Landlords Place Importance on Credit Scores?

Credit scores act as a shorthand evaluation tool, giving landlords insight into an applicant’s financial behavior. A strong credit score typically suggests that the renter is likely to:

- Pay rent on time.

- Fulfill the lease agreement without disputes or interruptions.

- Maintain a financially stable and predictable lifestyle.

In contrast, renters with lower credit scores may face skepticism about their ability to adhere to these expectations. Landlords, particularly in a city like Santa Fe where rental demand often exceeds supply, can afford to be selective. This high demand means that applicants with stronger financial profiles are often prioritized, leaving renters with bad credit in a challenging position.

Caption: Renters with lower credit scores may face skepticism

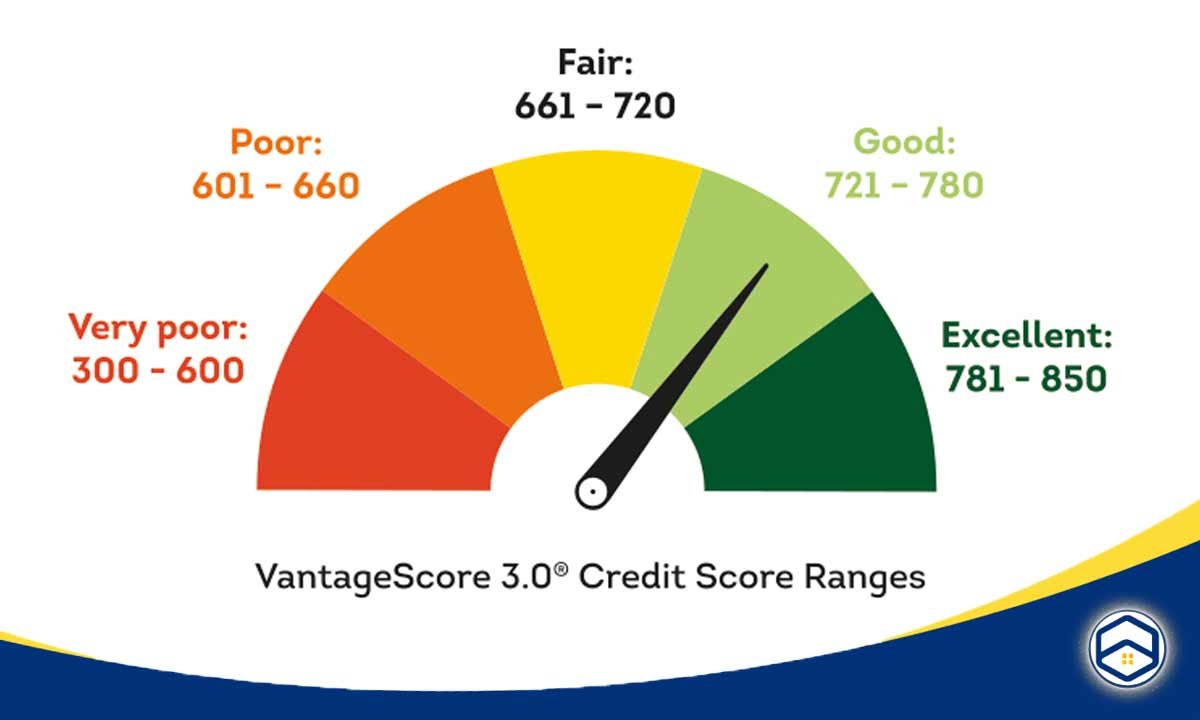

Alt: A pie chart showing the different credit score ranges and their corresponding labels. highlighting the importance landlords place on credit scores when evaluating potential tenants.

Addressing Landlord Concerns

To increase your chances of success, it’s essential to proactively address potential concerns:

- Transparency: Be upfront about your credit history and provide a clear explanation of past financial difficulties.

- Compensation: Offer solutions such as a larger security deposit or prepaying several months of rent.

- References: Strengthen your application with glowing recommendations from previous landlords or employers.

By understanding these challenges and taking proactive steps to mitigate them, renters with bad credit can improve their prospects of securing housing in Santa Fe.

Overview of the Santa Fe Rental Market

Santa Fe boasts a rich blend of architectural styles and living environments, from its iconic adobe-style homes reflecting Southwestern charm to sleek, modern apartments catering to urban tastes. Popular neighborhoods such as Casa Alegre, Arroyo Chamisa, and Downtown Santa Fe are highly coveted, known for their proximity to amenities, cultural landmarks, and vibrant local communities.However, the appeal of Santa Fe comes at a premium:

- Rental Prices: The average rental rates are on the higher side compared to other New Mexico cities. For example, a one-bedroom apartment might cost between $1,200 and $1,800 per month, depending on location and amenities.

- Low Inventory: Housing availability is tight, with many listings receiving multiple applications soon after they’re posted.

These factors make it critical to approach the market with preparedness and flexibility.

Key Challenges for Renters renting with bad credit Santa Fe

Renting with bad credit Santa Fe comes with several hurdles, particularly for those with less-than-ideal credit:

- High Competition: The city’s low vacancy rate leads to intense competition, especially for desirable properties in well-connected neighborhoods.

- Limited Affordable Options: Budget-friendly rentals are scarce and often come with strict eligibility criteria, such as higher income requirements or extensive application processes.

- Seasonal Trends: Rental availability may fluctuate based on seasonal demand, with peak times during the summer months when tourism and relocation rates are higher.

Tips for Renting with Bad Credit Santa Fe

Overcoming the challenges of renting with bad credit requires a proactive approach and thorough preparation. By employing strategic steps and leveraging available resources, renters can position themselves as reliable candidates despite a lower credit score.

Strengthening Your Rental Application

A compelling rental application can help alleviate landlord concerns. Here’s how to stand out:

Demonstrate Financial Stability

- Provide clear proof of your ability to afford rent.

- Submit documents such as recent pay stubs, bank statements, or a copy of your annual tax return. These demonstrate consistent income and responsible money management.

Secure Strong References

- Obtain letters from previous landlords or employers that highlight your reliability, timely payments, and responsible behavior as a tenant.

- A positive rental history can carry significant weight in the decision-making process.

Negotiate Higher Deposits

Offering a larger security deposit shows a commitment to the property and reduces perceived risks for landlords. Some landlords may also agree to a few months’ rent in advance as an alternative to a high deposit.

Be Transparent and Honest

Address your credit issues upfront. Explaining the circumstances that led to your credit challenges, accompanied by evidence of improvement or a clear financial plan, can foster trust.

Utilizing Local Resources to Find Rentals

Leveraging available tools and connections in Santa Fe can uncover rental opportunities tailored to your situation:

Explore Online Rental Platforms

- Utilize sites like Zillow, Apartments.com, or Rent.com to search for properties that specifically mention flexible credit policies or options for those with bad credit.

- Look for filters or keywords such as “no credit check” or “bad credit accepted.”

Tap into Networking Opportunities

- Join Santa Fe community groups on social media platforms like Facebook or Nextdoor. Members often share rental opportunities or leads on landlord-friendly properties.

- Contact local real estate agents who specialize in rental properties. They may have insights into landlords willing to work with renters facing credit challenges.

Seek Help from Nonprofits and Housing Agencies

- Local organizations, such as Santa Fe Housing Action Coalition or similar groups, may offer guidance, programs, or even direct support in finding rentals.

- These agencies sometimes have access to affordable housing lists or can connect you to landlords more open to working with individuals rebuilding their credit.

Additional Tips for Success

- Improve Your Credit Score Gradually: While searching for a rental, take steps to address any outstanding debts or errors on your credit report to present a stronger application in the future.

- Consider Co-Signers or Roommates: Having a co-signer with good credit or sharing a lease with a financially stable roommate can increase your approval chances.

Rent-to-Own Options in Santa Fe

Rent-to-own agreements can be a valuable alternative for individuals with bad credit seeking housing stability while working toward homeownership. This pathway combines the benefits of renting and owning, offering both immediate housing and a long-term investment opportunity.

Rent-to-own arrangements allow renters to lease a property while reserving the option to purchase it at a predetermined price after a specified period, usually 1 to 5 years. A portion of the monthly rent is typically allocated toward the future purchase, serving as a built-in savings mechanism. During this time, renters can address credit issues, save for a down payment, or build financial stability.

Key Features of Rent-to-Own Contracts:

- Option Fee: Renters often pay an upfront option fee (1-5% of the home’s price), securing the right to buy the property.

- Purchase Price Lock-In: The future purchase price is usually determined at the start of the lease, which can protect against market fluctuations.

- Monthly Rent Credits: A portion of each rental payment may contribute to the eventual purchase price.

Benefits for Renters with Bad Credit

Rent-to-own agreements offer several advantages tailored to individuals with credit challenges:

- Lock in a Future Purchase Price: Secure a home at today’s market value, even as property prices rise.

- Establish Payment History: Consistent rental payments under these agreements demonstrate reliability, benefiting your credit profile.

- Time to Rebuild Credit: Renters can work on improving their credit score and reducing debt while maintaining housing stability.

Local Opportunities in Santa Fe

Santa Fe’s housing market features select rent-to-own opportunities that can be uncovered with the help of experienced real estate professionals:

- Local Real Estate Agents: Agents specializing in alternative financing or unique rental agreements can connect renters with landlords offering favorable terms.

- Independent Property Owners: Some landlords may consider rent-to-own arrangements, particularly for long-term tenants with strong references or steady income.

Related post: Affordable Monthly Rent in Santa Fe: a Guide to Budget-Friendly Rentals

Resources for Renters Exploring Rent-to-Own

Santa Fe offers programs and resources to support renters, particularly those navigating financial difficulties:

- Affordable Housing Programs: Local organizations like the Santa Fe Housing Trust assist in finding and funding affordable housing options.

- Federal Assistance: Section 8 vouchers may supplement rental payments, easing the financial burden for low-income families.

Rent-to-own solutions in Santa Fe provide a promising avenue for individuals seeking housing and financial progress. By understanding the terms and leveraging local resources, renters with bad credit can pave the way to homeownership.

Conclusion

Renting with bad credit Santa Fe is undoubtedly challenging, but it is far from impossible. By understanding the market, preparing a strong application, leveraging local resources, and working to rebuild your credit, you can successfully secure housing. Stay proactive and persistent, and explore the strategies outlined in this guide to turn your rental aspirations into reality.