December 15, 2023

How to Calculate Gross Rent Multiplier Formula In Real Cases

In the current economic landscape of 2023, decision-making in investments has taken a long time and faced challenges. Besides, they don’t clear the next step to enrich their property in the Real Estate Field. In this scenario, for those seeking opportunities in Real Estate, the Gross Rent Multiplier Formula stands as a crucial arrow.

Learning about how to calculate the Gross Rent Multiplier Formula is one of the keys to having assurance and efficiency in property evaluation. In this article, we delve into the practical application of the GRM formula, providing insights into its usage in real-world cases.

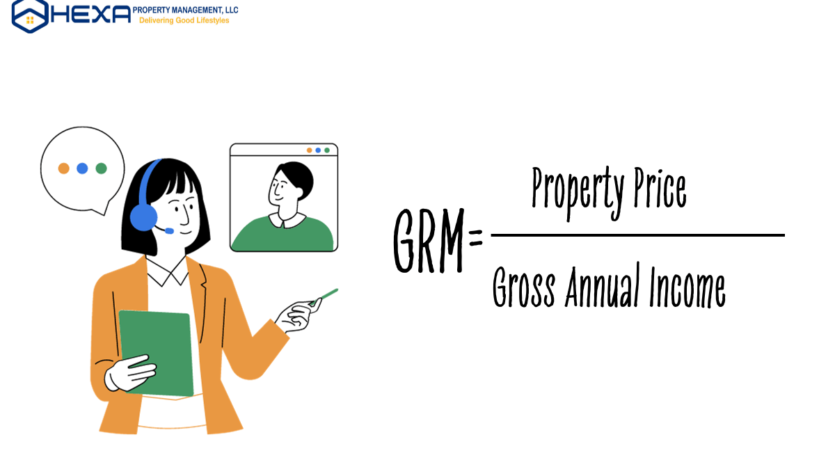

Understanding the Gross Rent Multiplier (GRM) Formula

The GRM is a straightforward formula used by both investors and landlords to measure a property’s earning power. It provides a quick overview of a property’s profitability compared to others in the same real estate market. The formula is expressed as follows:

Property prices refer to the monetary value assigned to real estate, encompassing residential, commercial, or industrial properties. These prices are affected by various factors, including location, size, condition, amenities, and overall market dynamics. Property prices fluctuate based on supply and demand dynamics, economic conditions, interest rates, and other variables.

Annual Gross Rental Income (AGRI) is the total rental income generated from a real estate property over a year. To calculate AGRI, use the following formula:

AGRI=Monthly Rent×Number of Months in a Year

What is a “Good” GRM?

A lower Gross Rent Multiplier (GRM) is generally considered favorable in real estate investment, as it may indicate a potentially quicker return on investment (ROI).

After calculating your GRM using the formula provided, you can assess and compare it with GRMs from comparable properties.

For instance, consider a potential real estate investment with a GRM of 5. When compared to other properties in the vicinity with GRMs of 7 or 9, the property with a GRM of 5 may be beneficial. This is a signal for a more lucrative investment opportunity.

Significance of GRM in Economic Downturns

During economic contractions, traditional investment choices may become uncertain. The GRM formula offers a focused approach, allowing investors to assess a property’s income potential among economic challenges. Its simplicity and quick applicability make it a go-to tool for rapid evaluations.

As traditional investments waver, the GRM remains a reliable metric for property evaluation. Unlike other financial model, the GRM’s simplicity becomes a formidable asset, offering a quick yet thorough evaluation of whether a property is a good investment during economic challenges.

Investors can lean on its uncomplicated nature to gain insights into a property’s potential income, allowing for a more stable and grounded approach to decision-making in times of economic uncertainty.

When do we should use the Gross Rent Multiplier (GRM) Formula?

In the world of real estate decisions, the Gross Rent Multiplier (GRM) Formula is like a handy tool with specific uses. Knowing when to use GRM can be crucial when dealing with property investments. This simple and effective formula comes in handy in different situations, helping investors make smart choices.

Let’s check out when GRM can be super useful.

1. Comparing Investment Opportunities

- When: You’re considering various investment opportunities and need a quick metric for income potential.

- Why: GRM facilitates a straightforward comparison of potential returns on investment for different properties, aiding in decision-making.

2. Market Analysis

- When: You are analyzing a real estate market to assess the income potential of properties in a specific area.

- Why: GRM supports you in understanding how properties in the market compare in terms of income potential, providing insights for strategic decisions.

3. Basic Income Assessment

- When: You’re looking for a simple yet effective method to assess the income potential of a property.

- Why: GRM is a user-friendly formula that provides a quick and insightful snapshot of a property’s profitability, making it suitable for an initial income assessment.

Whether you’re comparing investments, analyzing markets, or just checking basic income potential, GRM gives you a quick and reliable way to figure out how good a property might be.

As real estate keeps changing, using GRM is a smart way to make clear and efficient decisions in the unpredictable world of property investments.

For example in a Scenario

Consider a situation where a property is priced at $400,000 with an annual gross rental income of $48,000 during an economic downturn. Applying the formula:

Based on GRM we can have a statement that “A lower GRM in this scenario could signify a more favorable investment, as it suggests it take over 8 years to recover the property cost through rental income”. Moreover, we can give you some suggestions for using GRM effectively in reality:

- Consider Comparative GRMs: Compare this GRM with others in the market to gauge its competitiveness. If similar properties have higher GRMs, it might indicate a relatively better investment opportunity.

- Factor in Market Trends: Analyse broader market trends and economic forecasts. A low GRM might be advantageous in the current economic climate, but understanding the overall market trajectory is crucial for long-term decisions.

- Evaluate Risk Tolerance: Assess your risk tolerance. A lower GRM may imply a slower return on investment, so understanding your willingness to wait for returns is vital.

- Account for Property Management: Ensure you’ve factored in potential expenses, property management costs, and maintenance. A lower GRM doesn’t guarantee profitability if unforeseen costs are unconsidered.

Pros and Cons of Using the GRM Formula in Economic Downturns

As we delve into the pros and cons of the GRM formula, we unravel its simplicity and universal understanding, making it a potential tool in challenging times.

Understanding tools like GRM is crucial in economic downturns. It’s basic but effective, helping in quick assessments during market chaos, and promoting collaboration in real estate. However, GRM has downsides. It might miss property depreciation and important costs, affecting accuracy.

Finally, comparing the pros and cons is vital for smart decisions in the ever-changing world of economic uncertainties.

Pros of using Gross Rent Multiplier

Simple to Use

In times of economic challenges, the simplicity of the GRM formula becomes even more advantageous. It is a straightforward way to allow for quick assessments in a complex market.

Universal Understanding

The GRM concept is universally understood in the real estate industry. Collaborating with investors or property managers during economic downturns is streamlined, as they grasp the power of the GRM in assessing potential opportunities.

Consistency Across Properties

GRM tends to remain consistent for similar properties in a specific market, even during economic downturns. This stability delivers a reliable understanding of the overall area’s income potential. However, everything has two sides, The disadvantages points of GRM are the list helps you make the right decisions and the cons of using the Gross Rent Multiplier.

Cons of using Gross Rent Multiplier

Depreciation Oversight

The GRM formula lacks consideration for property depreciation. In economic downturns, when property values may fluctuate in economic downturns, relying solely on GRM might overlook the impact of depreciation on the property’s value.

Expense Exclusion

GRM solely relies on gross rental incomes, excluding critical factors like expenses, maintenance, taxes, and vacancies. In economic challenges, these exclusions can lead to a skewed assessment of the property’s profitability.

In the complex economic landscape of 2023, where investment decisions are taking long-time decisions and facing uncertainties, the Gross Rent Multiplier (GRM) Formula is considered a vital tool for those investors in the Real Estate Field. As we explore how to calculate the GRM Formula and its practical applications, we uncover its significance, especially in hard economic times.

We know the challenges you meet in this economic situation, you can search us – Hexa Property Management. By entrusting your real estate investments to Hexa, you gain not only the advantage of the GRM formula but also a partner dedicated to maximizing the profitability and stability of your real estate portfolio.